Research

Read More Research NewsSarah Kienle, Ph.D., assistant professor of biology at Baylor University, has received the prestigious Career Development Award from the National Science Foundation’s Faculty Early Career Development (CAREER) Program in support of early-career faculty who have the potential to serve as academic role models in research and education and to lead advances in the mission of their department or organization.

With Waco, Texas in the path of totality for the 2024 solar eclipse, Baylor University researchers have a first-hand opportunity to study the effects that people might feel as they witness this once-in-a-lifetime experience.

Rebecca Jones-Antwi, Ph.D., assistant professor in the Department of Public Health in Baylor University’s Robbins College of Health and Human Sciences, has received a three-year Career Development Award from the American Heart Association for her project, “Stuck in the Middle: The Intersectionality of Multiracial Adults and Cardiovascular Health.”

Yang Li, Ph.D., assistant professor of environmental science at Baylor University, has won a competitive NASA Early Career Investigator Program in Earth Science award that supports outstanding scientific research and career development of scientists and engineers at the early stage of their professional careers.

Announcements

Read More AnnouncementsBaylor University’s Dunn Center for Christian Music Studies in the Baylor School of Music has been awarded a four-year $1 million grant from Lilly Endowment Inc. as part of its Strengthening Congregational Ministries with Youth Initiative.

Following a national search, Toby J. Brooks, Ph.D., assistant dean of faculty success, program director of athletic training and professor at the Texas Tech University Health Sciences Center (TTUHSC) in Lubbock, has been selected to serve as director of Baylor University’s Academy for Teaching and Learning (ATL), effective July 15, 2024.

After a three-year hiatus after the pandemic, the Baylor Community Garden is back and thriving through the collaborative efforts of more than 700 students, faculty and staff, the garden has blossomed into a “site of transdisciplinary environmental discovery, creativity and community health."

Baylor University Provost Nancy Brickhouse, Ph.D., announced today the appointment of Elisabeth R. Kincaid, J.D., Ph.D., as director of the Institute for Faith and Learning (IFL), effective Aug. 1. She also will serve as associate professor of ethics, faith and culture in Baylor’s George W. Truett Theological Seminary and affiliate faculty member in the Department of Management in the Hankamer School of Business.

Accolades

Read More AccoladesA record 16 Baylor University students and recent alumni have been selected for Fulbright U.S. Student Grants from the U.S. government’s flagship international educational exchange program that offers students grants to pursue graduate study, conduct research or teach English abroad.

Stephen Sloan, Ph.D., professor of history and the director of the Institute for Oral History at Baylor University, was honored as the 2024 Cornelia Marschall Smith Professor of the Year at the annual Academic Honors Convocation on April 19.

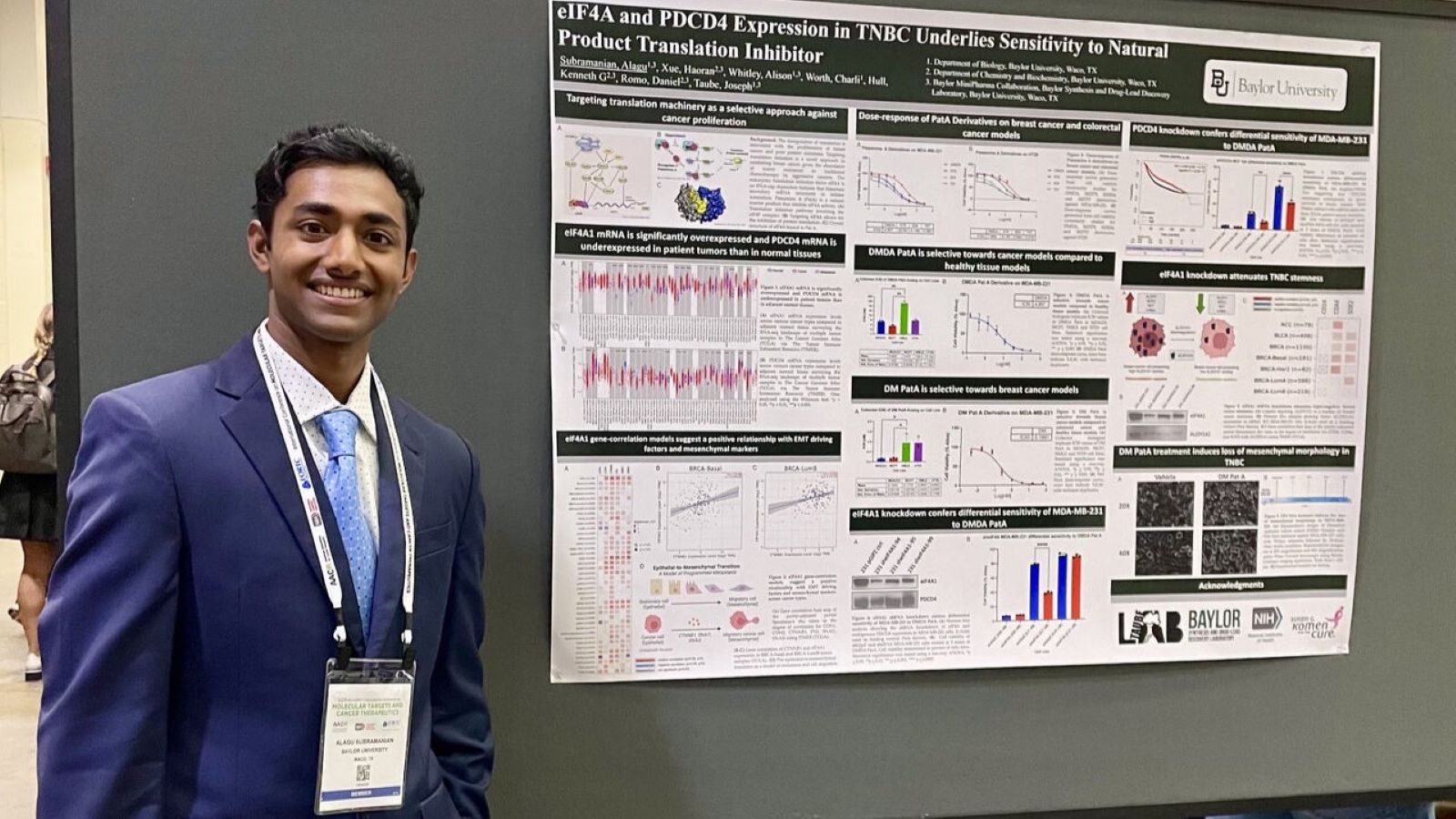

Alagu Subramanian, B.A. ’23, a University Scholar with concentrations in biology, medical humanities and business administration, is Baylor University's fourth consecutive Churchill Scholar, an unprecedented achievement for the prestigious and highly selective scholarship in science, mathematics and engineering.

Twelve Baylor University professors have been honored with Outstanding Faculty Awards for teaching, scholarship and contributions to the academic community for the 2023-2024 academic year.

Hot Topics

Read More Hot TopicsBaylor education expert offers tips on how to enjoy the eclipse with children

Baylor mathematics chair Dorina Mitrea, Ph.D., explains what makes Pi important.

Anyone who has traveled has probably experienced jet lag – that exhausted feeling that comes after long travel and trips. With the spring and summer travel seasons ahead, travelers can prevent some of the effects of jet lag through planning and preparation, says Baylor University sleep expert Michael Scullin, Ph.D..

WACO, Texas (Dec. 21, 2023) – From the traditional sound of Go Tell it on the Mountain to the contemporary style of Kirk Franklin, Black Gospel Christmas music conveys a sense of wonder and passion for the Christmas season and the birth of our Savior. Two Baylor University experts in Black gospel music, Bob Darden and Stephen Newby, share their love of the rich sounds of Christmas spirituals.