Personal "Touch" Portfolio (PTP): Connecting with the Right Clients

By Andrea L. Dixon, PhD

What causes most sales professionals sleep loss? "Satisfying my current clients" is frequently close to the top of the list. Yet, while many sales agents focus on current clients, they under-invest in activities to generate new clients. And, when they do connect with current clients, sales agents attempt to tap their existing clientele for referrals using email "blasts" and other "efficient" or what might be deemed impersonal approaches. However, some clients should receive more personalized, closer touches from you. Keeping personally connected with the right existing clients is important for long-term success. So, which clients should be hearing from you more than once a year through more personal touches? In this article, we examine the metrics used for client analysis to help you select the right clients to maintain in your Personal Touch Portfolio.

Identifying the Right Existing Clients for the PTP

The process of defining the right client to receive personal touches has escalated in complexity. A variety of metrics exist but not all guarantee that you are focused on the right clients for long-term profitability (Reinhartz and Kumar 2003). While you know that all clients are not alike, the question remains: how should you identify the right clients, among your existing clients, upon which to focus your more personal marketing efforts? To cut to the chase, we must say that there is not a single metric that allows you to easily identify the right clients for your more personal marketing efforts. So, we offer you several common metrics to consider when identifying the right clients for your Personal Touch Portfolio.

Client Satisfaction

Strengthening relationships with satisfied clients is important as satisfaction is a key driver of client loyalty and retention (Gupta and Zeithaml 2006). Typically defined as a client's judgment that a product/service meets or exceeds expectations (a disconfirmation of expectations model), client satisfaction improvements are shown to have significant and positive impact on financial performance. Yet, the relationship between satisfaction and financial performance shows substantial variance (Gupta and Zeithaml 2006). So, satisfaction is one useful criterion in deciding with whom to keep in personal touch. Action item for the sales agent: Do you give your clients the opportunity to rate their satisfaction with you, the buying/selling process, the home purchased (among buyers) and the deal struck (among sellers)? Do you capture that satisfaction information in a client database so you can use this information as one factor when prioritizing your PTP clients? Highly satisfied clients should be considered for regular contact in your PTP.

Client Loyalty

Client loyalty is a deeply held commitment to repurchase from a sales professional in the future, despite competitors' efforts to attract that client (Oliver 1997). Based on their research, Reinartz and Kumar (2002) recommend that sales agents pay attention to the use of attitudinal indicators to examine true client loyalty:

Are you loyal to NAME of SALES AGENT or NAME of BROKERAGE OPERATION?

Are you interested in switching to another sales agent or brokerage firm for your next residential real estate need?

Action item for the sales agent: Do you have data by which you can gauge your clients' attitudinal loyalty to you or their propensity to use another sales agent for their next home purchase? Clients reporting strong loyalty should be considered for regular contact in your PTP.

Purchase History

Marketers commonly use client purchase history information to identify the right clients for marketing campaigns as such data serve as drivers of important outcomes. The Reach Frequency Monetary (RFM) model uses historical purchase data to score clients on the basis of how recently they made a purchase (recency), how often they purchase (frequency), and how much they typically spend (monetary). Unfortunately, typical RFM scoring approaches result in an overinvestment of lapsed clients (Reinartz and Kumar 2002). However, we see some interesting applicability of this model to residential real estate. Action item for the sales agent: Do you engage your current clients in a "historical walk through" of their home purchases, asking when they purchased their first home, what was important to them as they made that purchase, and what circumstances prompted them to move to their next home? After asking about their first home, repeat this line of questioning to understand the client's entire home purchase history. By capturing this "home history," you can identify how the RFM model relates to each client:

- What are the drivers of the client's recent move(s) vs. the move(s) made earlier in the client's life? (recency)

- How frequently has the client moved over his/her life? How has that frequency changed over the last part of the client's move history? (frequency)

- How the home needs have changed over time? How have the client's career situations changed over time and affected the financial resources? (monetary)

You may want to increase the frequency of your personal touch among clients who have:

- Lived in their current home for 5 years or more.

- Changed their household structure (more or fewer members) or experienced job advancement recently.

Net Promoter Scores

Clients should be part of your PTP if they are advocates for you. Client advocacy can be measured through a variety of means. The Net Promoter® Score, introduced by Reichheld and commercialized by Bain & Company, represents a loyalty and advocacy metric calculated via a single question (Reichheld 2006; www.netpromoter.com):

How likely is it that you would recommend [NAME] to a friend or colleague?

The single question is posed to current clients in order to classify them into three groups according to their responses on a 0-to-10 point rating scale:

- Promoters (score 9-10): loyal enthusiasts who continue buying and referring other clients

- Passives (score 7-8): satisfied clients who lack enthusiasm and attitudinal loyalty, making them particularly vulnerable to competitor's activities

- Detractors (score 0-6): dissatisfied clients may damage your brand and reputation, hamper new client acquisition, and impede your growth through negative word-of-mouth.

Action item for the sales agent: The opportunity from this metric is pretty clear as sales agents should query their current clients regularly to determine if they are promoters, passives or detractors. You should plan to touch "Promoters" regularly as part of your PTP. While the Net Promoter Score concept has been adopted quite extensively, Keiningham, Cooil, Andreassen, and Aksoy (2007) caution that future client loyalty behaviors, such as retention, share of wallet, and word of mouth, are distinct. Consequently, no single measure appears to adequately predict future loyalty behaviors among clients (Keiningham and Aksoy 2008).

Client Advocacy

Research shows that internet shoppers choosing an online retailer as a result of WOM referrals yield more sales than do internet shoppers who "search" the Internet to find a product (Choi, Bell, and Lodish 2008). So, having current clients refer prospective clients through social networks and word of mouth is an important part of the "right client" discussion (Blackshaw 2008). Today, WOM or client advocacy measures can be more than self-reported via surveys. You can easily identify, track and measure the impact that individual clients may have on your business through your client's online activities, such as blogging, posting to message boards, answering questions for other clients in online forums, etc. Researchers are just beginning to understand and incorporate these measures into analysis for defining the right client (Blackshaw 2008). Sales and marketing professionals will likely experiment with a variety of measurement approaches while scholars and consultants create a foundation of current research. Action item for the sales agent: One way to track your clients' advocacy is to set up a web-based alert for your name and your firm's name. Using Google (www.google.com) for example, or another search engine, you can have a daily digest of web-based mentions pushed to your computer. Sales agents can easily identify and capture the source of the mention into their PTP and keep track of which clients are serving as on-line advocates, making it relatively easy to identify priority clients for personal touches.

Profitable Loyalty

It should be clear by now that defining the right clients for the PTP requires attending to multiple dimensions of client behavior, client attitudes as well as client profitability - both historical and future profitability. Client profitability analysis, which involves estimating the profitability of individual clients, can be accomplished via a variety of measurement processes (Heitger and Heitger 2008). IPSOS, an international marketing research firm operating in 64 countries (www.ipsos.com) offers a proprietary composite measure called Profitable Loyalty to help its clients create stronger financial performance. The IPSOS measure focuses attention on clients showing greatest Profitable Loyalty across three dimensions: attitude (affective commitment, brand preference), behavior (share of wallet, momentum, which is recent change in behavior), and value (profitability) (Keiningham and Aksoy 2008). Although this Profitable Loyalty measure comprises a good balance of dimensions, it is a proprietary measure so we do not have direct access to their methodology. However, we can consider IPSOS' measure when identifying factors to consider for our PTP work. Action item for the sales agent: Assuming that you have identified the need to capture and track satisfaction, loyalty, and advocacy, consider tracking the value of the historical home purchases as well as some estimate of your time required to facilitate each sale. For example, if one client takes 2-3 years of "looking" before moving, that client might represent a different profitability outcome than the client who looks and decides typically within a 4-6 month window. The "big idea" with profitable loyalty is to identify the value as well as the cost-to-serve for your clients so you can prioritize your personal touches for clients who represent the best return.

Client Lifetime Value (CLV)

The measures that we have considered thus far might be considered "backward-looking measures" in that they focus on past patterns of behaviors, attitudes and profits and therefore suggest that the future will reflect patterns of the past. Yet, we know that in prioritizing clients for our PTP, we might consider present profitability as well as future profit potential (Niraj, Gupta, Narasimhan 2001). One such measure, the lifetime value of a client (CLV) is defined as the present value of all future profits achieved from a specific client during the length of the client's relationship with you. Using CLV to guide your client relationship efforts allows you to strategically focus your time, marketing dollars and resources on those clients representing the best long-term potential.

Measuring Client Lifetime Value

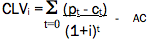

Calculating the lifetime value of a single client can be quite challenging. While there is an array of CLV formulas, the basic components of most calculations include current revenues and expenditures for a client, projected duration of the client relationship, projected revenues and expenses for the client for duration of the relationship, and projected interest rates for each year of the relationship. In fairness, CLV is really more of an orientation or a mindset than it is a specific formula. Since the calculations proposed by many academicians can be quite onerous, we recommend that sales agents wishing to embrace the lifetime valuation process begin with a conceptual equation as a starting point. An example from Gupta and Zeithaml (2006):

Where Pt = listing price paid for a home by a client at time t Ct = direct cost of servicing the client at time t, including the cost of the home (minus commissions) and the cost to serve the client during the hone buying process i = discount rate or cost of capital T* = expected lifetime of a client AC= initial acquisition cost for that client A common approach used to estimate the expected lifetime of a client is to limit the calculation to a three- to five-year-range. Yet, to make the CLV measurement meaningful in residential real estate, we do not recommend using a limited time horizon. Action item for the sales agent: Think about how the concept of CLV might shape your behavior and engagement with clients. Consider how you might include an estimation of future value in your assessment process for the PTP. Don't get lost in the particulars of an equation.

Summary

Highly satisfied clients should be high priorities for the sales agent's Personal Touch Portfolio. Other measures discussed in this article are also useful for prioritizing PTP clients. In fact, the composite CLV captures the future value represented by the client as well as several other key dimensions:

- loyalty -- by including the expected length of a relationship for future financial calculations,

- profitable loyalty -- by including cost-to-serve elements in the calculation, and

- purchase history -- by including listing price paid for homes over time.

Ignored by the CLV measure but also important for prioritizing personal contacts is each client's potential to be your loyal advocate. Sales agents should plan to personally touch those clients who are loyal advocates as evidenced through net promoter scores, survey-reported word-of-mouth advocacy, and demonstrated online advocacy. Clearly, the most crucial clients to stay in touch with are those providing the highest level of current profit margin and promising the highest levels of future profit potential (largest lifetime valuation). In addition to these current and future profitability dimensions, sales agents should also prioritize personal contacts toward a client who demonstrates his willingness to be loyal advocate.

. . . . . . . . . . . . . . . . . . .

References and Suggested Readings

Blackshaw, Pete (2008), Satisfied Clients Tell Three Friends, Angry Clients Tell 3,000: Running a Business in Today's Consumer-Driven World, New York: Doubleday Publishing. Choi, Jeonghye, David R. Bell, and Leonard M. Lodish (2008), "The Role of Local Environments in Customer Acquisition Online," MSI Reports Working Paper Series, Issue Four. Gupta, Sunil and Valerie Zeithaml (2006), "Client Metrics and Their Impact on Financial Performance," Marketing Science, 25 (6), 718-739. Heitger, Lester E. and Dan L. Heitger (2008), "Jamestown Electric Supply Company: Assessing Client Profitability," Issues in Accounting Education, 23(2), 261-280. Keiningham, Timothy and Lerzan Aksoy (2008), "The Quest for Profitable Loyalty," Marketing Science Institute Conference Presentation, Marketing Metrics for the Connected Organization, September 10-12, Dallas, Texas. Keiningham, Timothy L., Bruce Cooil, Tor Wallin Andreassen and Lerzan Aksoy (2007), "A Longitudinal Examination of Net Promoter and Firm Revenue Growth," Journal of Marketing, 71(3), 39-51. Keiningham, Timothy L., Bruce Cooil, Lerzan Aksoy, Tor Wallin Andreassen and Jay Weiner (2007), "The Value of Different Client Satisfaction and Loyalty Metrics in Predicting Client Retention, Recommendation and Share-of-Wallet," Managing Service Quality, 17(4), 361-384. Kumar, V., Rajkumar Venkatesan and Werner Reinartz (2006), "Knowing What to Sell, When and to Whom," Harvard Business Review, March, 131-137. Kumar, V. and Morris George (2006), "A Comparison of Aggregate and Disaggregate Level Approaches for Measuring and Maximizing Client Equity," American Marketing Association 2006 Winter Educator Conference Proceedings, 142-143. Niraj, Rakesh, Mahendra Gupta, and Chakravarthi Narasimhan (2001), "Client Profitability in a Supply Chain," Journal of Marketing, 65 (July), 1-16. Oliver, Richard (1977), Satisfaction: A Behavioral Perspective on the Consumer, New York: McGraw-Hill. Reichheld, Fred (2006), The Ultimate Question: Driving Good Profits and True Growth, Boston, MA: Harvard Business School Press. Reinartz, Werner and V. Kumar (2003), "The Impact of Client Relationship Characteristics on Profitable Lifetime Duration," Journal of Marketing, 67 (January), 77-99. Reinartz, Werner and V. Kumar (2002), "The Mismanagement of Client Loyalty," Harvard Business Review, (July), 86-94. Reinartz, Werner and V. Kumar (2000), "On the Profitability of Long-Life Clients in a Noncontractual Setting: An Empirical Investigation and Implications for Marketing," Journal of Marketing, 64 (October), 17-35. Thomas, Jacquelyn S., Werner Reinartz, and V. Kumar (2004), "Getting the Most out of All Your Clients," Harvard Business Review, July-August, 117-123. www.google.com www.ipsos.com

. . . . . . . . . . . . . . . . . . .

About the Author

Andrea Dixon, PhD

Executive Director, Keller Center for Research and Center for Professional Selling

Frank M. And Floy Smith Holloway Professorship in Marketing, Baylor University

Dr. Andrea Dixon (PhD - Indiana University) is the Executive Director of the Keller Center for Research and the Center for Professional Selling. She is the Frank M. & Floy Smith Holloway Endowed Professor in Marketing at Baylor University. Coming from an industrial background in research, planning and advertising, her research interests embrace behavioral issues related to sales, service and client satisfaction. Andrea has published in the Journal of Marketing, Harvard Business Review, Organizational Science, Journal of the Academy of Marketing Science, Leadership Quarterly, the Journal of Personal Selling and Sales Management, The Journal of Satisfaction, Dissatisfaction and Complaining Behavior, and several other journals. In 2002, Dixon's research published in the Journal of Marketing was selected as the award-winning research in the sales area. Prior to joining Baylor, Dixon was the Executive Director of the MS-Marketing Program and the Ronald J. Dornoff Teaching Fellow at the University of Cincinnati. She has co-authored the book, Strategic Sales Leadership: BREAKthrough Thinking for BREAKthrough Results, and multiple industry-wide research texts. Dixon serves on two editorial review boards and co-chaired the American Marketing Association's 2007 Winter Educator Conference. While serving as a faculty member at the University of Cincinnati (U.C.) and Indiana University-Bloomington (I.U.), Dr. Dixon taught an array of graduate and undergraduate courses. One of U.C.'s MBA EXCEL Teaching Award winners, Dixon was selected for a national teaching award by Irwin Publishing, as a distinguished professor by Indiana University MBA students, and for a university-wide award by her academic colleagues at I.U. In 2008, she was named the Academy of Marketing Science's Marketing Teacher Award winner. Prior to teaching at U.C., Andrea worked closely with GAMA International as the Senior Director of Product Development and Marketing.