INSIDER: Making the Customer Comfortable With You

By Drew Johns, MBA Candidate

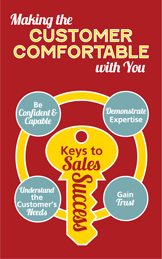

Customers have more power in the buyer/seller relationship than most people think. The relationship is dependent on how a customer relates and reacts to the salesperson. As a salesperson or agent, you must monitor and analyze how comfortable the customer is with you and your business throughout the entire sales process. From the first impression to the closing of a deal, the customer must believe that the salesperson is looking out for his or her best interests. The level of risk that customers are willing to take on during the purchase process will define how strong of a relationship they require with the salesperson. Customers making a lower risk purchase have different needs than those making a high-risk purchase. The buyer will require a stronger relationship with the seller as the risk of the purchase increase. Potential costs resulting from making a bad investment can range from an outlay of cash and time to physical and emotional stress on the body. To alleviate and mitigate the risk of taking on a bad investment, a rational customer will do his due diligence and then perhaps require a strong relationship with his salesperson. The stronger the relationship between the two individuals, the more proactive the pair can be in resolving conflicts as they arise. If the customer is not satisfied with the level of rapport the salesperson is creating, he will either leave and find an alternative or be discontent and difficult to work with. Both scenarios are a lose/lose situation for the salesperson. Cultivating a relationship with your customer and making the customer comfortable with you is an ongoing process that must evolve with the changing demands of each party. In

How to Sell Anything to Anyone Anytime (2011), Dave Kahle outlines how making the customer comfortable fits into the sales process. This article will investigate four key components that help a salesperson make the customer feel comfortable.

THINK POINT #1: Be confident and capable

Projecting passion and having conviction for one's work will signal that you have the capability to succeed at a specific task. The buyer wants to know that you are qualified and have the competence to act in his best interest. Building rapport and finding common ground with the customer helps the buyer discover who you are as a person. One good way to build rapport for yourself and for your company would be to discuss recently achieved individual or company goals. Sharing small "success stories" provides a platform for you to speak intelligently about your company and reveal individual strengths, which then begin to align with the customer's predetermined expectations. Adapting the conversation and preparing for the unexpected shows you are capable and proficient in performing your job, which puts the buyer at ease.

THINK POINT #2: Demonstrate expertise for credibility

Practice and experience help in the process of gaining confidence in one's work. Preparation is crucial to ensuring you understand not only the product inside and out, but also the customer's wants and needs. Take time to become an expert about your product, including history, features, functions, strengths and limitation. A successful, expert salesperson is able to understand his product from all angles and then adapt the product presentation to align with customer demands. Knowing what to say is important, but knowing how to say it will give you an extra edge. Your presence and nonverbal communication can send a strong message to the customer. Sending a positive signal is simple: keep good posture, make eye contact, be well groomed and monitor gestures. Professional expertise is gained through interactions and tenure on the job. Obtaining job-specific credentials through continued education, licensures and designations, and other industry-specific certifications can help sales agents develop a deeper understanding of the real estate field.

THINK POINT #3: Gain the customer's trust

In addition to professional competence and know how, integrity and trust are two significant values that drive credibility. Building a strong character is a result of consistency in one's actions, attitudes, and values. If you make an agreement or promise to the customer, make sure you adhere to your word. Having an optimistic and positive outlook toward your work enables the customer to feel comfortable and confident in your abilities. A solid reputation cannot be earned overnight. Earning trust and credibility with your customers and within your community will pay dividends down the road. Participating in community outreach programs, serving on local committees, and investing in other community activities is important both for personal and professional development. If the salesperson is straightforward and dependable, he will gain the customer's trust much more quickly than someone who is not.

THINK POINT #4: Understand the customer's needs

The salesperson must be able to learn what the customer's goals and objectives are in order to address their needs. Effective communication is imperative when trying to relate to the customer. You must ask the right questions in order to get the right answers. Preliminary research about the customer through LinkedIn or other social media mediums may also help you get a better idea of who they really are. Encouraging interaction will enable a salesperson to monitor the quality of the relationship. The proactive salesperson will address potential problems before the customer begins to have doubts. Following up with the customer after a purchase to resolve any conflicts created in the closing process can generate long-term value in the relationship

. . . . . . . . . . . . . . . . . . . .

Recommended Reading

Kahle, Dave (2011).

How to Sell Anything to Anyone Anytime, Pompton Plains, NJ: Career

. . . . . . . . . . . . . . . . . . . .

About the Author

Drew Johns, MBA Candidate, May 2011, Baylor University

Graduate Assistant, Keller Center for Research

Drew is a second-year graduate student from Mansfield, TX. He earned his BBA with a major in finance from Baylor University.