Health Care: Planning for Baby Boomer Retirement

By Concha Neeley, PhD, Holt Wilson, DBA and Crina Tarasi, PhD

The Baby Boom Generation, born between 1946 and 1964, has played a dominant role in the residential real estate market over the past four decades. As this generation enters the golden years, retirement and relocation decisions will have a major impact on supply and demand of real estate throughout the U.S. State and local governments are counting on the current wave of retiring Baby Boomers to "revitalize lagging real estate and construction markets, create new jobs and generate more tax dollars" (Frank 2007). Economic development planners are targeting this market with campaigns and programs designed to attract individuals in the early retirement stages to live in their cities. Actively marketing to retain older clients in communities will be critical over the next couple of decades. Specifically, real estate professionals will play a key role in retention efforts as they are hired to sell the homes of this influential and aging generation. The leading edge of the Baby Boomer Generation is now 65 years old and the elderly population will begin exceeding younger adults (Myers and Ryu 2008). The real estate generation gap has begun and will continue to impact communities over the next few decades. As baby boomers retire and downsize, there will be a flood of inventory on the market that may not be suitable for the next generation of buyers (Kalita and Whelan 2011). Millennials don't want their parents' formal living and dining rooms, cookie cutter suburban housing and a long commute. Additionally, this new generation bears heavy college loan debt and is apprehensive about taking on mortgages. With the conflicting needs of the next generation of home buyers, cultivating relationships and retention of empty nesters in existing suburban developments may be a strategy worth pursuing. Recent articles have considered the best practices for selling to the new generation of home buyers (Schetzsle and Rusk 2011) and the importance of engaging in non-traditional communication and service delivery. While new home buyers from the Millennial Generation are gaining importance in the real estate market, the Baby Boom Generation will continue to shape the housing market for the foreseeable future. This article presents results of a recent study examining factors influencing retirement decisions of the aging Baby Boom population.

Baby Boomers and Retirement

We conducted a study to examine how people who are nearing retirement, or are recently retired, think about certain aspects of retirement. Our study findings assist real estate professionals in developing an understanding of the factors that influence retirement and relocation decisions as they attempt to offer housing solutions in or near the sellers' current location. The survey was completed by 507 U.S. home owners; 52.1% male and 47.9% female. Seventy-two percent of respondents were either married or living with a significant other. Of these respondents, 53.6% were currently retired. The remaining respondents expect to retire on average within the next 8.5 years.

Retirement Location Features

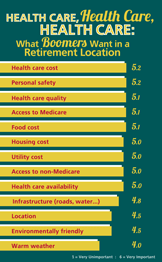

We asked respondents to rate the importance of various features considered in their retirement location decision making process. Following is a list of those features with the mean response for each item (1 = very unimportant and 6 = very important). We have listed them in order of most to least important according to survey participants.

| Retirement Location Features | Importance |

|---|---|

| Health care cost | 5.2 |

| Personal safety | 5.2 |

| Health care quality | 5.1 |

| Access to Medicare | 5.1 |

| Food cost | 5.1 |

| Housing cost | 5.0 |

| Utility cost | 5.0 |

| Access to non-Medicare | 5.0 |

| Health care availability | 5.0 |

| Infrastructure (roads, water...) | 4.8 |

| Location | 4.5 |

| Environmentally friendly | 4.5 |

| Warm weather | 4.0 |

Empty nesters surveyed are primarily concerned with access to affordable and quality health care and appear to be less concerned with entertainment and amenities for active lifestyles such as hiking, golf and tennis. Weather was of somewhat neutral importance.

Income Sources

Respondents were asked to rate the importance of the following sources of income after retirement (1 = very unimportant and 6 = very important):

| Source of Income After Retirement | Importance |

|---|---|

| Social Security | 5.3 |

| Personal savings | 4.6 |

| Pension | 4.6 |

| Other personal investments | 4.1 |

| IRA of some type | 3.9 |

| 401(k) or similar plan | 3.8 |

| Sale of real estate | 3.6 |

The likelihood that respondents would work full or part time after retirement was split; 28.6% answered very unlikely to work, 13% said moderately unlikely and 10.3% responded somewhat unlikely to work full or part time. The remaining 48.1% said they were somewhat likely to very likely to work full or part time after retiring. Because many retirees will be seeking part time or full time post-retirement employment, accessibility to jobs will be an important factor in relocation decisions.

Retirement Relocation

There is discussion in the popular press about the growing trend toward overseas retirement among Baby Boomers. In our study, only 2.4% of respondents said they were very likely to consider retiring outside of the United States and 60.7% were very unlikely to consider an overseas retirement location. The following shows the interest level of retiring in the US compared to other international locations. Respondents were asked to rate how interesting (1 = not at all interesting and 6 = very interesting) they considered each of the following countries as a possible place to retire:

| Country Considered for Retirement Location | Average Level of Interest |

|---|---|

| United States | 5.7 |

| Canada | 2.1 |

| Costa Rica | 1.75 |

| Italy | 1.7 |

| England | 1.7 |

| Spain | 1.6 |

| Belize | 1.6 |

| France | 1.6 |

| Panama | 1.4 |

| Thailand | 1.3 |

| Taiwan | 1.2 |

| India | 1.2 |

| China | 1.2 |

Implications

This article provides a foundation for understanding factors Baby Boomers consider as they enter retirement and make decisions regarding relocation. Real estate professionals should work together with planning and development agencies to ensure retention of the retiring Baby Boom Generation. Communities will continue to rely on spending and tax dollars even as the empty nesters begin to downsize their current living situation. It is important for all constituents to be active in combating oversupply of housing as demand decreases. Focusing on construction or revitalization of commercial property to provide amenities for the aging population will also aid in preventing further declines in property value. City governments should invest in affordable and quality medical care to retain or attract Baby Boomers as they retire and consider relocation options. Medical care quality and affordability as well as overall cost of living should be a theme used in marketing campaigns targeted at this generation. Respondents tend to anticipate relying heavily on social security and personal savings with sale of their own real estate property relatively neutral. Failing property values along with savings deficits and poor stock market performance will impact retirees' ability to relocate. Our study indicates that retiring outside of the U.S. is not on the radar for most respondents. Over 60% of respondents said they would be very unlikely to consider retiring outside the USA, while only 6.3% were somewhat likely to very likely to consider an overseas retirement location. These findings bode well for efforts of real estate professionals and urban planners as they seek to retain residents within their communities. The real estate generation gap is just beginning with implications for decades to come. Real estate professionals should be aware and adaptive to the different needs of two distinct generations and characteristics of each. While forecasting the potential "sell-off" driven by Baby Boomer retirement is difficult, real estate professionals, planners and developers should be aware of the needs of the aging population and strive to retain home owners in their current market to prevent decline of property values and desirability of neighborhoods flooded with vacancies.

. . . . . . . . . . . . . . . . . . .

References

Carmichael, Mary (2007, March 25), "The Real Estate Generation Gap," Boston Globe Magazine, Retrieved June 30, 2011, from https://www.boston.com/realestate/luxuryliving/articles/2007/03/25/the_real_estate_generation_gap." Daily Real Estate News (Oct 2010), "How to Reach the Millennials." Frank, Patricia (2007), "Communities Aim to Mine Golden Years: Cities Compete to Attract Retiring Baby Boomers," American City & County, 122 (6), 16, 18. Kalita, S. Mitra and Robbie Whelan, (2011), "No McMansions for Millennials," www.wsj.com, Jan 14. Myers, Dowell and SungHo Ryu (2008), "Aging Baby Boomers and the Generational Housing Bubble," Journal of the American Planning Association, 74 (1), 17-33. Schetzsle, Stacey and Casey Ray Rusk (2011), "Value-Based Service Quality for the New Generation of Home Buyers," Keller Center Research Report, June 2011, Baylor University.

. . . . . . . . . . . . . . . . . . .

About the Authors

Concha Neeley, PhD

Assistant Professor, Department of Marketing and Hospitality Services Administration

Central Michigan University

Dr. Neeley earned a PhD from the University of North Texas, an MBA from the University of South Alabama and a BA in Advertising from Texas Tech University. Prior to entering academia, Dr. Neeley held business-to-business sales positions with both product and service firms and served as a consultant for the Small Business Development Center at the University of South Alabama. Dr. Neeley's work has been published in multiple journals and presented at numerous conferences. Dr. Neeley's current teaching and research interests are in the areas of professional selling, sales management and inter-organizational relationships. She is the founding faculty member of the Professional Sales program at Central Michigan University.

Holt Wilson, DBA

Professor, Department of Marketing and Hospitality Services Administration

Central Michigan University

Dr. Wilson has undergraduate degrees (BA - economics and BS - chemistry) from Otterbein College, an MBA from Bowling Green State University (statistics), and a doctorate from Kent State University with majors in both marketing and economics. He has published articles in economic, forecasting, and marketing journals, as well as over 10 textbooks in these disciplines. He is a member of the American Marketing Association, the Society for Marketing Advances, the International Institute of Forecasters, and the Marketing Management Association.

Crina Tarasi, PhD

Assistant Professor, Department of Marketing and Hospitality Services Administration

Central Michigan University

Dr. Tarasi earned a PhD from Arizona State University and an MBA from Central Michigan University. Her research centers on issues related to the marketing/finance interface, particularly those that center on customer portfolio design and the profit impact of marketing strategy decisions. She has published in the Journal of Marketing and other marketing journals and contributed chapters on customer relationship management.