Making a House a Home: On Happiness & Home Ownership

By Jim Roberts, PhD

The Greek philosopher Socrates identified happiness as the ultimate goal of all human activity - everything we do is with this end in mind. And, because happiness is the end-goal of all we do, happiness can be considered an unconditional good. Happiness is not achieved through worldly goods (e.g., money or possessions), but in how an individual chooses to use such things. Money, for example, is a conditional good. The attitudes one holds toward money and how it is spent will determine whether it will bring happiness or sorrow. If money is squandered and becomes the ruling force in your life, it can foster more sorrow than good. On the other hand, used wisely, money can be a positive force, bringing much happiness to you and others around you. The same rationale can be applied to purchases in the real estate industry. Buying a house (and the means by which we buy a house) has the power to move us toward happier and more fulfilling lives, but it also can promote disappointment, debt and ultimately, greater sorrow. The key to maximizing happiness through the purchase of real estate is this: recognize that there is a difference between purchasing a house and purchasing a home. The how and why behind the purchase of a home will determine whether or not it will be a source of happiness or a source of sorrow.

Shiny Objects - In Pursuit of the American Dream

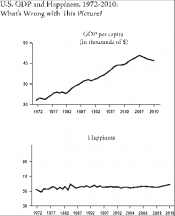

Shiny Objects: Why We Spend Money We Don't Have in Search of Happiness We Can't Buy (Roberts 2011) discusses the many misguided attempts Americans make in trying to achieve happiness. It is no surprise that many Americans believe happiness can be achieved through money and material possessions. Madison Avenue spent $131 billion in 2010 attempting to convince Americans that happiness can be purchased at the mall, online or from a catalog (Kantar Media 2010). By some estimates, the typical American is exposed to 5,000 advertising messages daily (Story 2007). We have bought into the notion that happiness can be purchased. Average credit card debt in the U.S. currently stands at nearly $ 9,000 per household and 70% of US households live paycheck-to-paycheck (National Payroll Week 2008). The average Baby-Boomer is approaching retirement with a paltry $50,000 in savings--not even enough to purchase some of the luxury automobiles on the market today (Retirement Confidence Survey 2011). The most telling evidence that all this spending isn't getting us any closer to real happiness is represented in the following two charts which look at the comparison of GDP to happiness:

GDP for earlier years has been adjusted to current dollars. Happiness data was taken from the General Social Survey (GSS) of over 50,000 people and represents the percentage of people who responded "pretty happy" to the question: "Taken all together, how would you say things are these days, would you say that you are very happy, pretty happy, or not too happy (General Social Survey 2010)?" What the two graphs tell us is that although our GDP (which is largely a measure of personal spending) has increased nearly every year since 1970 (with slight disruptions for recessions), our happiness has flat-lined. We seem to be no happier today than we were in 1970, despite an ever-increasing wealth of material possessions. In fact, we are more anxious, stressed out, and depressed than any preceding generation of adults (Twenge et al. 2010).

Happiness and the Real Estate Industry

Recall that happiness is an unconditional good - and material possessions, like houses, are conditional goods whose ability to produce a desired level of happiness is contingent upon how they are used. If consumers continue to view real estate solely as an investment and/or a status symbol, real estate purchases will rarely deliver the desired happiness we strive to achieve. Flipping houses, buying purely with an eye on ROI or buying homes to impress others can be a recipe for disaster - we saw this throughout the Great Recession of 2008. But there is hope. We must begin to remember that our house-purchases can be more significant than material investments; they are really home-purchases - time, money and resources spent to develop an environment that is family-oriented, comfortable, secure, and focused on long-term rewards. By making a shift in purchasing mentality, our real estate purchases may actually begin helping us move toward happier and more fulfilling lives. Of all the places we can spend our hard-earned money, a home has the most promise. A home, however, can only deliver on this promise if we are careful in how we go about buying our homes. We must buy for the long-term, focusing less on flipping properties for a quick profit in the short-term. The home should be purchased with a fixed-term, 15-year loan, and should stay well within the family budget. Standards differ, however 25% of your take-home pay makes for a sensible maximum house payment. It is also wise to have a good handle on what it costs to maintain your house. Many home owners are overwhelmed when they find out, albeit too late, how much heating and cooling, water, and routine maintenance add to their monthly bills. With the unexpected costs of a new roof, air-conditioning unit repairs or a new hot-water heater, the monthly maintenance costs of home ownership can get out of control. If consumers choose to follow these simple guidelines, the home has a real chance of becoming a place of comfort, utility and security - a place to be family - which all contribute to our enduring happiness. Owning a home is an integral part of the American Dream. As history professor Thomas Sugrue puts it, "To own a home is to be American. To rent is to be something less" (Sugrue 2009). So, does home ownership really make us happier? A recent survey by Harris Interactive for The National Association of Realtors seems to suggest that owning your home does make us happier (National Association of Realtors 2011). The online survey of 3,793 US adults was conducted in October of 2010 and was weighted to represent the US population of adults 18 years of age and older. Key findings of the survey reveal that home owners are "much more likely to be satisfied with the quality of their family and community life than renters." In fact, 93% of home owners surveyed are happy with their decision to purchase a home. Additionally, nearly two-thirds of renters want to own their own home in the future.

Conclusion

Americans buy real estate for many reasons - however, Americans purchase a home to provide a safe place to raise their children and to be members of a community. Owning a home is not solely a financial matter, but part and parcel of what it means to fully realize the American Dream. For real estate agents, this means that of all places consumers can spend their money, home ownership may be one of the few purchases that can deliver on the promise of greater happiness. Despite being uttered nearly 2,500 years ago, Socrates' advice still rings true today. The how and why behind the purchase of a home determines whether or not it will be a source of happiness.

. . . . . . . . . . . . . . . . . . .

References

Anonymous (2011), "American Attitudes About Homeownership," National Association of Realtors Survey. Anonymous (2011), "Kantar Media Reports U.S. Advertising Expenditures Increased 6.5 Percent In 2010," Kantar Media, March 17, accessed 1/30/12:

https://kantarmediana.com/intelligence/press/us-advertising-expenditures-increased-65-percent-2010. Anonymous (2011), Retirement Confidence Survey, accessed 1/30/12:

https://www.ebri.org/content/the-2011-retirement-confidence-survey-confidence-drops-to-record-lows-reflecting-the-new-normal--4772. Anonymous (2010), General Social Survey, accessed 1/30/12:

https://gss.norc.org/get-the-data/spss. Anonymous (2008), "Getting Paid in America", National Payroll Week Survey. Roberts, James A. (2011), Shiny Objects: Why We Spend Money We Don't Have in Search of Happiness We Can't Buy, New York: HarperCollins Publishers. Story, Louise (2007), "Anywhere the Eye Can See, It's Likely to See an Ad," New York Times, January 15, accessed 1/30/12:

https://www.nytimes.com/2007/01/15/business/media/15everywhere.html?pagewanted=all. Sugrue, Thomas J. (2009), "The New American Dream: Renting," Wall Street Journal, August 14, accessed 1/30/12:

https://online.wsj.com/article/SB10001424052970204409904574350432677038184.html. Twenge, Jean M., Brittany Gentile, C. Nathan DeWall, Debbie Ma, Katharine Lacefield, David R. Schurtz (2010), "Birth Cohort Increases in Psychopathology Among Young Americans, 1938-2007; A Cross-Temporal Meta-Analysis of the MMPI," Clinical Psychology Review, 30, 145-154.

. . . . . . . . . . . . . . . . . . .

About the Author

James A. Roberts

Ben H. Williams Professor of Marketing, Baylor University

Dr. Roberts is a well-known author with approximately 75 articles published in the academic literature. He is currently the Ben H. Williams Professor of Marketing at Baylor University in Waco, Texas where he has been a faculty member since 1991. His research regularly appears in many of the top marketing and psychology journals and has received two "Paper of the Year" awards. A primary focus of Dr. Roberts' work over the last 10-15 years has been the psychology of consumer behavior. He is somewhat of an anomaly among marketing scholars in that his research is largely focused on the "dark side" of consumerism and marketing. Current research efforts focus on the topics of materialism, compulsive buying, credit card abuse and self-control. His book, Shiny Objects, takes a careful and amusing look at how our love of material possessions impacts our happiness and what we can do to find true happiness in a culture awash in material possession love. Dr. Roberts is a nationally recognized expert on consumer behavior, has been quoted extensively in the media and has appeared on the CBS Early Show, ABC World News Tonight, Yahoo.com's "The Daily Ticker", Time.com, US News & World Report, New York Times, USA Today, The Wall Street Journal, National Public Radio, Cosmopolitan Magazine, Glamour, and many other newspapers, magazines, websites, and television appearances.